Ron Bishop provides overview of connector industry profitability from 2014 through 2023 in his article published by TTI Market Eye.

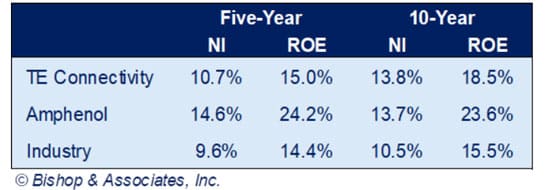

The connector industry is recognized for its ability to consistently achieve double-digit net income (NI) and return on equity (ROE). As shown in the chart below, over the past 10 years (2014 through 2023) the connector industry achieved an average NI of 10.5% of sales and 15.5% ROE.

The number one and two ranked connector companies (TE Connectivity and Amphenol) lead the industry in overall profitability.

Clearly the connector industry is exceptional, consistently achieving double-digit NI and ROE over the past 10-year period. How does this compare to other industries?

The following table compares the 2023 NI of other industries to the connector industry.

In 2023, the connector industry ranked fourth overall in profitability out of the 14 industries we analyzed. Granted, this analysis is only based on one year, 2023, but an industry that consistently achieves double-digit NI and ROE over the long term will always rank in the top of class.

Expanding on this, we thought it might be interesting to examine how sales performance, world GDP and connector prices might affect industry profitability. In that regard, we prepared the following table.

This table provides some interesting findings.

- In the past 10-years, industry sales declined in four years 2015, 2029, 2020 and 2023. Despite these declines, the connector industry still generated substantial profits.

- Except for 2015, where connector prices declined 2.0%, connector prices have increased or remained flat in the past 10 years. There was very little price erosion during this period.

- The industry remained profitable even in 2020 when GDP was 3.1% and connector sales were down 2.2%.

- The years 2021 and 2022 were exceptionally good years which generated high double-digit ROE, 16.5% and 18.6 respectively. Sales increased 24.7% in 2021 and 7.8% in 2022. The industry was also able to increase connector prices by 7.0% in 2021 and 8.0% in 2022.

- Price erosion is historically a killer of profits. Conversely, as seen in 2021 and 2022, prices increase will help generate profits.

In conclusion, the connector industry generates profits and significant ROE, a major reason why companies want to acquire connector companies and why since the beginning of the 21st century so many connector companies, small and large, have been acquired, not only by other connector companies, but also by companies focused on other industries and private equity companies.