Ron Bishop updates connector industry backlog, orders and revenue forecast in his article published by TTI Market Eye.

Backlog

The industry has been shipping $6,863 million on average per month since January 2023.

The May ending backlog balance was $22,033 million which equates to 12.8 weeks of backlog.

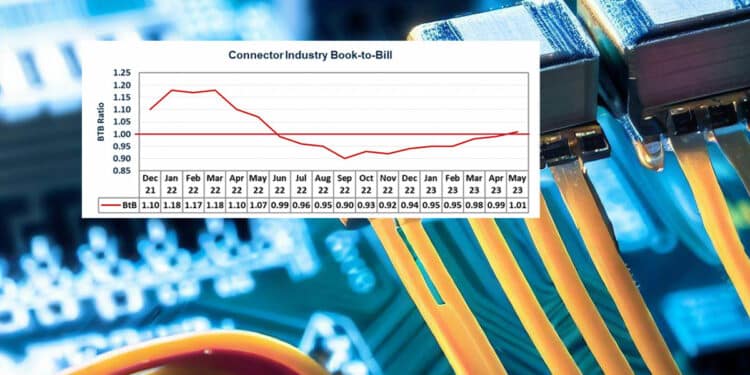

The industry has reported 11 consecutive months of a below-1.00 book-to-bill ratio.

In May, this trend reversed and for the first time in a year, the book-to-bill ratio was 1.0 or better. This is shown in the graph on Figure 1.

The May 2023 book-to-bill ratio was 1.01, which ends 11 consecutive months in which the industry shipped more than it booked. However, you will note in the following table, the backlog has remained in the $21-$22 billion level since November 2022.

Industry Orders – May 2023

Sales were down a modest 1.1 percent through May, but orders were down a whopping 14.0 percent year to date. In fact, orders have declined in 13 of the past 14 months, however, May orders were down only 7.0 percent, ending seven consecutive months of double-digit declines.

The slowdown in order demand is a function of a slowing global economy caused by high inflation, rising interest rates and overall economic uncertainty. Deteriorating relations with China and the Ukrainian war add uncertainty to global markets.

2023 and 2024 Forecasts

Through May 2023, world sales were $34,315 million, down 1.1 percent year to date from 2022. Orders have declined year over year in 14 of the last 15 months. The book-to-bill ratio has been below 1.0 in 11 of the last 12 months.

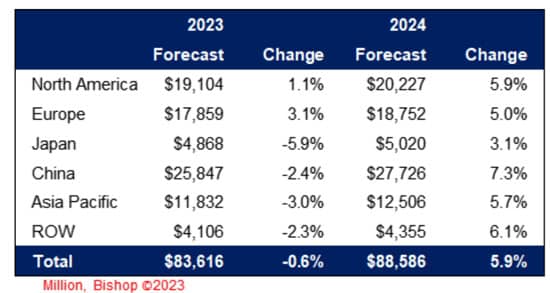

All of this makes it clear that global connector demand is soft. Additionally, we are not seeing encouraging signs that stronger connector demand is on the near horizon. As a result, we are forecasting 2023 connector sales at $83,616 million, down 0.6 percent from 2022 sales of $84,091 million.

The following table shows our forecast by geographic region for 2023 and 2024.

We are more optimistic about 2024, forecasting modest growth of 5.9 percent. There are several reasons for this forecast.

- Growth of 5-6 percent is the historical norm for the connector industry.

- Demand historically rebounds after a down year.

- GDP growth in North America is generally slightly higher in an election year.

- The job market is still strong in many parts of the world. Although layoffs have occured, particularly in the tech and media industries, people are finding new opportunities quickly.

The rate of inflation has slowed but raw materials and labor costs have remained high. As a result, connector prices will probably increase in 2024 which will add to the top line.