Samtec blog published interview with Ron Bishop – President of Bishop and Associates, connector industry expert, and friend of Samtec – and talked to him about what’s going on in the connector industry nowadays, and more importantly, what the future holds.

Electronic OEMs, AKA Samtec’s customers, frequently ask us about the “state of the union” of the connector industry. While electromechanical is not as high-profile or visible as the chip industry, connectors are an essential link in the EOEM supply chain.

How’s the Connector Industry Performing?

Bishop – We just completed our research on the first quarter of 2023 (1Q23). Sales were down -0.1% versus the same period last year, which is basically flat. This is significant because 1Q23 ended 10 consecutive quarters in which the industry achieved sales growth. It is important to note that seven of the last 10 quarters achieved double-digit sales growth.

Clearly, the above chart shows the sales trend is down. Are new orders and the existing backlog showing the potential for a quick rebound in sales?

Bishop – Unfortunately no. The connector industry has experienced a year-over-year decline in orders in 11 of the past 12 months. During the last six quarters, this decline has been in the double digits.

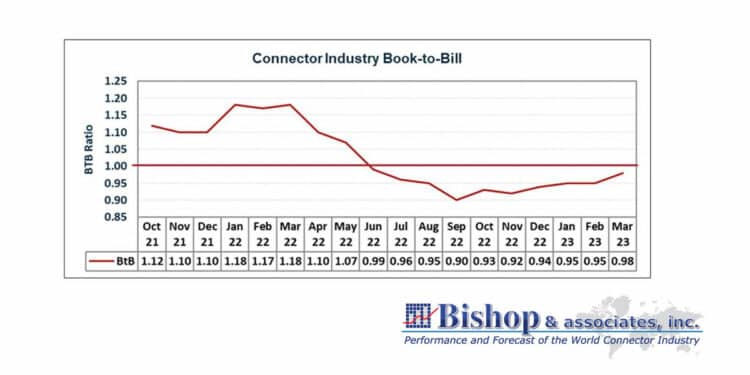

Additionally, the book-to-bill ratio has been below 1.0 for 10 consecutive months.

May 2022 was the last month in which orders exceed sales. This is noted in the following table.

Since May of 2022, the backlog has declined by $4.1 billion. However, on a more promising note, we have not seen any signs that customers are canceling orders or pushing out delivery dates.

Are there other signs that we are entering a down business cycle?

Bishop – Yes, particularly in the semiconductor industry. Historically semiconductor sales performance leads connector sales by a few months. The following chart displays semiconductor sales versus connector sales for the last 17 months. You will note that semiconductor sales have declined for seven consecutive months. Of these declines, four were double digits!

Year-to-date semiconductor sales were down -21.3%. Unfortunately, this is not an encouraging sign for the connector industry.

Another clear sign that the connector industry is entering a down business cycle is layoff announcements from tech companies. An online tracker (https://layoffs.fyi) has noted that 193,098 layoffs have already been announced in 2023 compared to 164,576 in all of 2022!

Some of the largest US-based companies are reducing staff. Among these are 3M, META, Dell, Boeing, IBM, Google, Microsoft, etc.

You have indicated we are entering a down business cycle in the connector industry. Historically how long do they last?

Bishop – Yes, we believe we are at the beginning of a new down cycle.

For the 21st century, we have experienced four down business cycles. The longest lasted six quarters and the shortest four quarters.

What is Bishop’s outlook for 2023?

Bishop – We have seen double-digit declines in orders, but not sales. That’s encouraging. Another encouraging sign is the performance of TE Connectivity and Amphenol, the two largest connector manufacturers. Both companies achieved sales growth in 1Q23 (TE = 3.8%; Amphenol 0.7%). Further, both companies are forecasting a very modest decline in second-quarter sales, TE -2.4% and Amphenol -1.0%.

Other encouraging signs include:

- A $22 billion connector backlog that is not being affected by order cancellations or push-outs.

- An expected pause in interest rate increases.

- A strong automotive market, the largest connector end-used equipment market.

- A strong military/aerospace market.

These factors suggest that the industry will probably not experience a double-digit decline in sales. We believe it is more likely that in 2023 sales will be flat in comparison to 2022.

Our forecast is a bit more positive, with growth at +1.9%.

You identified the markets that are performing well (automotive and military), can you give us an idea of what markets are not doing well?

Bishop – The double-digit decline in semiconductors is the result of poor performance in computers, mobile phones, and other data devices, and consumer electronic products such as white and brown goods.

All in all, we are not predicting that 2023 will be a disaster.